How Do You Compare Credit Card Processing Options for Your Small Business?

In today's digital financial system, accepting credit score cards is vital for any small business aiming to thrive. But with so many companies, prices, and systems in the marketplace, how do you pick out the best credit card processing small business needs?

The right solution lets you reduce costs, enhance coins, go with the flow, and streamline operations—while the wrong one ought to leave you paying pointless expenses. In this manual, we’ll damage down the way to examine your alternatives, what to search for in a provider, and how Renaissance Advisory enables small businesses reduce costs to in reality 0% with strategic service provider processing answers.

Why Credit Card Processing Matters for Small Businesses

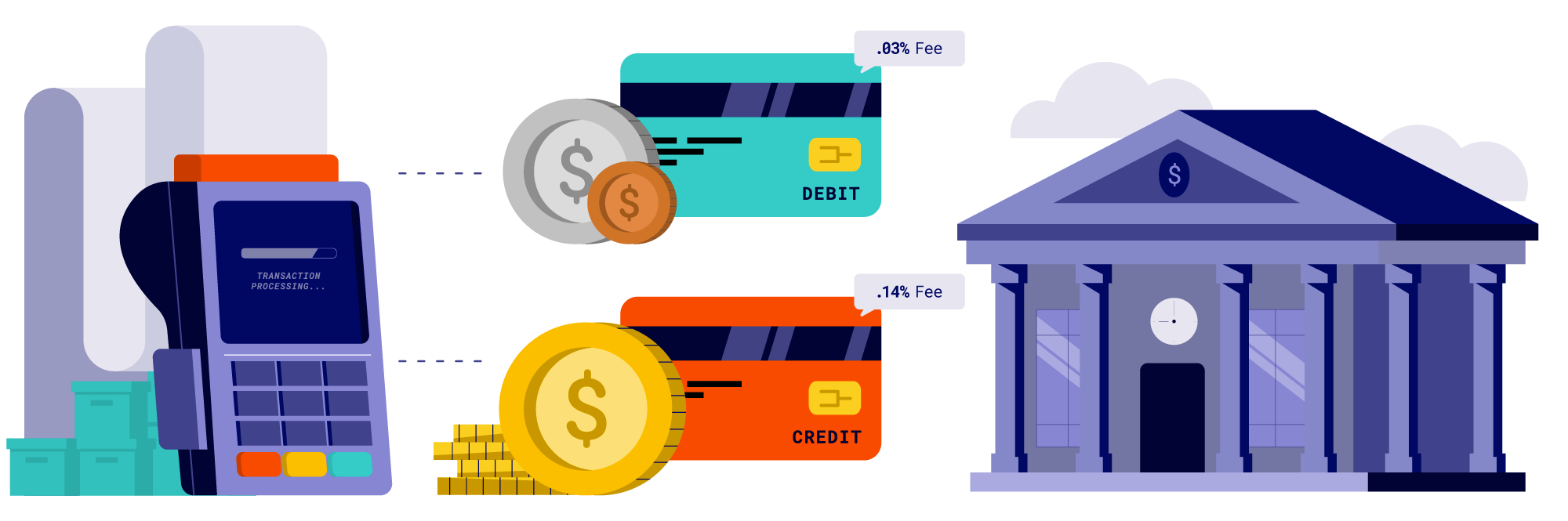

For small commercial enterprise proprietors, every dollar counts. Credit card costs would possibly appear like a necessary evil, however they can quietly drain heaps from your bottom line every year. Traditional processors frequently rate:

-

Interchange fees: Set by credit card networks

-

Markup costs: Set by means of the payment processor

-

Monthly minimums, PCI compliance prices, and declaration charges

It adds up rapidly. That’s why deciding on the right processor is extra than simply convenience—it’s a strategic financial selection.

Key Factors to Compare in Credit Card Processing Providers

When comparing credit card processing small business solutions, right here are the most essential elements to don't forget:

1. Pricing Structure

There are several pricing models available:

-

Flat-charge: Simple and predictable, however often higher normal charges.

-

Interchange-plus: Transparent and normally less expensive for better-volume companies.

-

Tiered pricing: Less transparent, can disguise fees.

-

Cash Discount / Dual Pricing: Passes charges to customers, probably decreasing your fee to zero%.

???? Pro Tip: Renaissance Advisory helps groups implement coins cut price and twin pricing packages which could clearly eliminate processing charges—without scary customers or disrupting sales float.

2. Equipment and Integration

Make certain the company gives:

-

Free or low-cost POS structures

-

Mobile charge alternatives

-

Integration together with your accounting and inventory systems

-

Contactless and EMV chip compliance

Some vendors lock you into proprietary gadgets, making it expensive to switch later. Renaissance Advisory works only with providers that provide seamless integration and unfastened gadget options.

3. Contract Terms

Be careful about:

-

Long-term contracts (regularly 3+ years)

-

Early termination fees

-

Auto-renew clauses

Look for vendors with month-to-month contracts and no cancellation consequences, especially if you're checking out the waters or scaling quickly.

4. Customer Support

Quick issue resolution topics. Ask:

-

Is help to be had 24/7?

-

Can you talk to a real person, not a chatbot?

-

Do they provide onboarding and education?

Small groups don’t have time to waste on payment system defects. Renaissance Advisory companions with processors that offer dedicated U.S.-primarily based support.

5. Reputation and Transparency

Check:

-

Online opinions and Better Business Bureau scores

-

Hidden prices within the contract

-

How well the processor educates and supports their clients

At Renaissance Advisory, transparency is non-negotiable. We vet all companions thoroughly to make certain our clients in no way address shady excellent print or hidden charges.

The Renaissance Advisory Advantage

Unlike general price processors, Renaissance Advisory takes a results-pushed, 100% contingency-based total approach. That means we don’t get paid unless we save you money. Our service provider processing service includes:

-

Fee removal techniques (Cash Discount & Dual Pricing)

-

Free equipment and setup

-

No hidden prices or lengthy-time period contracts

-

Expert integration with current structures

And due to the fact we additionally offer tax advisory services, our team appears past fee processing to help you store across your complete operation. Imagine combining:

-

Merchant processing charge savings

-

R&D Tax Credit recuperation ($50K–$500K+)

-

Section 125 Plans for payroll tax comfort

With this layered method, small businesses frequently discover tens of hundreds in hidden financial savings.

Quick Checklist: How to Compare Credit Card Processing Options

Before you sign on with a provider, run through this checklist:

✅ Do they offer a transparent pricing model (preferably Interchange-plus or Dual Pricing)?

✅ Are there hidden expenses or cancellation consequences?

✅ Is equipment included, or will you pay more?

✅ Does their device combine along with your cutting-edge tech stack?

✅ Can they assist you lessen or even cast off processing expenses?

✅ Is the company aligned with your commercial enterprise size, desires, and support desires?

Ready to Cut Your Processing Fees?

You don’t have to navigate credit card processing on your own. Whether you’re just starting out or managing more than one location, Renaissance Advisory can manual you to the maximum price-powerful setup—with zero premature price and no long-time period hazard.

???? Talk to an advisor today

???? Book your 10-minute consultation

???? See how much you can save

Why Work With Renaissance Advisory?

Renaissance Advisory isn’t simply any other tax advisory services. We’re built around one mission: assisting small companies hold greater in their hard-earned cash. Our offerings are:

-

Contingency-based totally (we don’t get paid except you keep)

-

Tailored (we personalize based totally on your enterprise desires)

-

Comprehensive (we find financial savings throughout taxes, blessings, and operations)

Let us show you how credit score card processing is just the beginning of your full-scope financial savings strategy.

What's Your Reaction?

.jpg)