India Cryptocurrency Market Size, Trends, CAGR and Report 2025-2033

The market is primarily driven by blockchain innovation, higher awareness of digital financial solutions, growing interest in decentralized platforms, faster adoption of technological innovations, changes in clarity of regulations, greater access to the trading infrastructure, the introduction of educational courses that focus on blockchain, and the emergence of crypto-based financial products that make for a dynamic investment ecosystem.

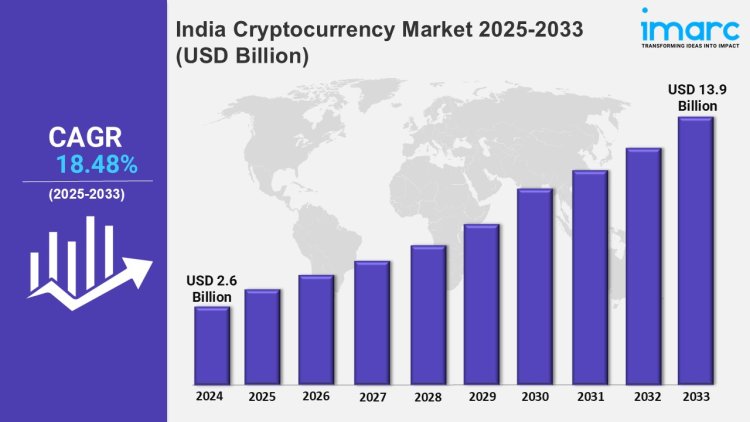

India Cryptocurrency Market 2025-2033

According to IMARC Group's report titled "India Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033", the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Cryptocurrency Market CAGR and Size:

The India cryptocurrency market size was valued at USD 2.6 Billion in 2024 and is projected to grow to USD 13.9 Billion by 2033, with an expected compound annual growth rate (CAGR) of 18.48% from 2025 to 2033.

India Cryptocurrency Market Trends:

The Indian Cryptocurrency market has seen significant changes in the last few years due to the development of its regulation and increasing digital adoption. Long seen with doubt, cryptocurrency such as bitcoin and atherium has attracted attention to technology-loving investor population, which is uncertainly slanting. Decentralized finance platforms and NFT have attracted more interest in the market, both retail and institutional. Some compulsory alternative-mostly emerged in some essentially unbanked areas of Peer-to-Pier Trading Platform Operation have emerged significantly.

The regulator uncertainty, however, continues the single biggest challenge as the government promoted a possible CBDC law, taking a vigilant posture towards government cryptocurrency. In addition, increasing integration of blockchain technology in industries such as finance, supply chain and healthcare created interest in digital assets. Although the market was once prone to unstable instability, the acceptance of cryptocurrency as a valid asset class seems to be a marker of maturity for long -lasting.

Request Free Sample Report: https://www.imarcgroup.com/india-cryptocurrency-market/requestsample

India Cryptocurrency Market Scope and Growth Analysis:

India's crypto space is poised to see incredible growth as it has a sizable population of generation Z and millennial tech lovers with growing Internet penetration. We have many opportunities to enable the use and adoption of cryptocurrency for India's over 700 million Internet users. Along with mushrooming fintech startups and blockchain-based solutions, India has a robust ecosystem for innovation. Due to increasing interest in alternative investment options over low-yielding, traditional investments, the Indian investment community is increasingly focused on investments in cryptocurrency.

Also, the market will benefit from user-friendly trading platforms and wallet solutions being developed for safe trading, thereby improving user trust and usability. While rule changes are occurring in the space, the government's focus on creating a digital economy is a sign of a progressive vision. In addition, border crossing transactions and financial inclusion are emerging reasons why cryptocurrencies matter for India's economy. A better awareness of and increased infrastructure support for cryptocurrency can help drive further growth. In many ways, crypto has opened up a new Vista to various stakeholders in India, including investors, businesses, and policy makers.

India Cryptocurrency Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India cryptocurrency market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Analysis by Type:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Analysis by Component:

- Hardware

- Software

Analysis by Process:

- Mining

- Transaction

Analysis by Application:

- Trading

- Remittance

- Payment

- Others

Regional Analysis:

- South India

- North India

- West & Central India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=9084&flag=C

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

.jpg)