Reclaim Your Financial Legacy: Essential Share Recovery Services in India

Many investors are unaware of the unclaimed or lost investments under their names or those of their family members. With changing rules, digital transitions, and personal documentation gaps, reclaiming these assets can be challenging.

With changing rules, digital transitions, and personal documentation gaps, reclaiming these assets can be challenging. Thats where Share Recovery Services come into playhelping individuals legally reclaim what is rightfully theirs.

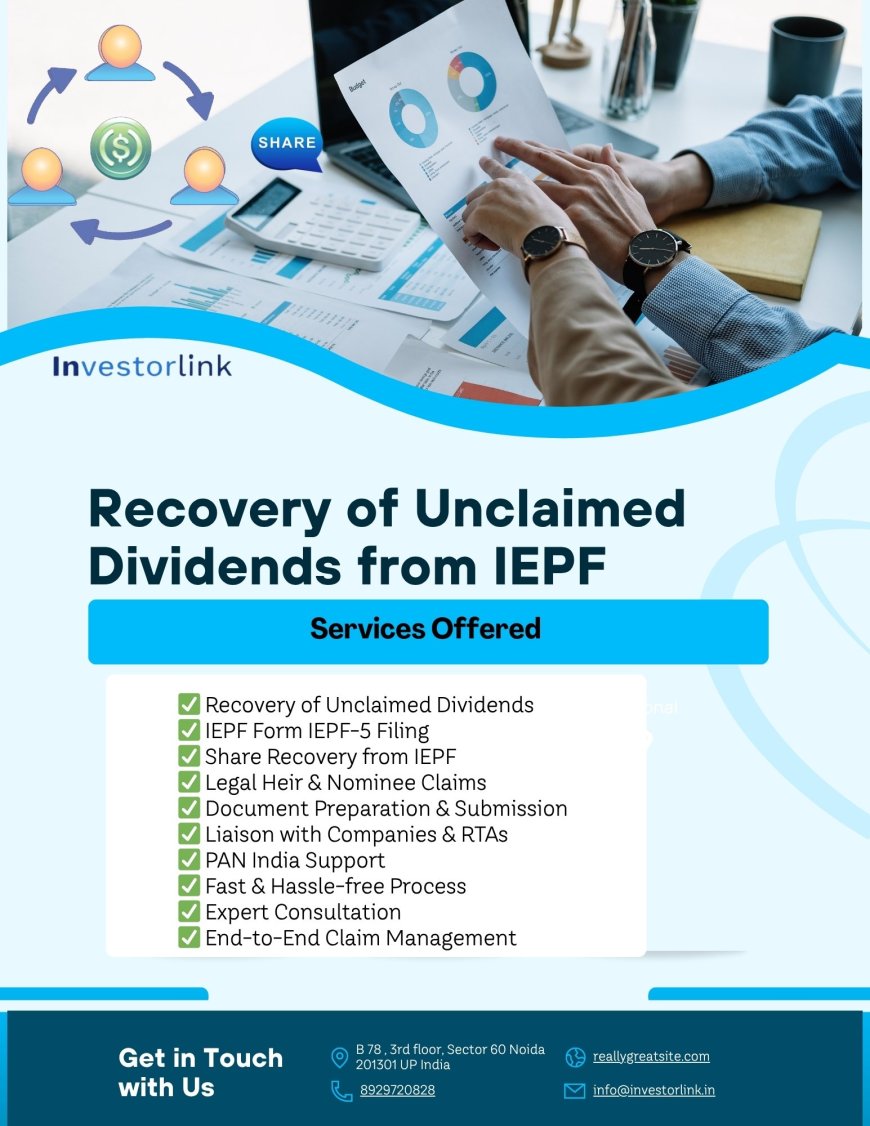

Following the initial recovery solutions like duplicate share certificates, name correction, and IEPF recovery, here are three more critical services that ensure complete financial recovery.

1. Transmission of Shares

When a shareholder passes away, the ownership of their shares doesnt automatically transfer. The legal heirs must undergo the Transmission of Shares process by submitting documents such as a death certificate, succession certificate, or probate of will. Its a legal procedure and not a sale, requiring precision and compliance with the company and regulatory norms.

2.

You might be unaware of investments made by you or your loved ones in the past. Through PAN-based searches, old address tracing, and financial registries, experts help you trace forgotten or unclaimed investments in shares, dividends, or mutual funds. This service is ideal for families handling old portfolios or dealing with inherited financial documents.

3. Dematerialisation of Shares

Physical share certificates are outdated, risky, and no longer accepted for trading. Dematerialisation converts paper shares into electronic form via a Demat account. This process involves verification, RTA coordination, and account linkage with NSDL or CDSL. Once dematted, shares are easier to transfer, manage, and sell.

Frequently Asked Questions (FAQs)

Q1. What is the difference between Transmission and Transfer of shares?

A: Transmission happens after the death of a shareholder (legal process), while transfer is a voluntary act of selling or gifting shares.

Q2. How can I check if I have unclaimed shares?

A: Experts use your PAN, address, or folio details to scan databases like IEPF, RTA records, and SEBI to trace unclaimed investments.

Q3. What if I dont have the original share certificate for demat?

A: You must apply for a duplicate certificate first, then proceed with dematerialisation.

Q4. Is it mandatory to dematerialise physical shares?

A: Yes. As per SEBI guidelines, physical shares cannot be traded; demat is essential for smooth transactions.

Q5. Can legal heirs dematerialise inherited shares?

A: Yes, once shares are transmitted in their name, they can be dematerialised by opening a Demat account.

Author: Mahima Singh

IEPF Recovery Specialist | Financial Recovery Guide

Take action now dont let your investments go unclaimed.

Explore services at InvestorLink.in